Considering purchasing a home? Chances are, mortgage rates are at the forefront of your mind. Understanding how they impact your monthly payments is crucial as you plan your next move.

With the recent flurry of headlines surrounding rates, navigating this topic can feel overwhelming. Here’s a simplified breakdown to help you make sense of it all.

The Current Landscape of Mortgage Rates

Rates have been fluctuating, exhibiting volatility. Why? The reasons are multifaceted, influenced by various economic indicators such as the job market, inflation rates, decisions by the Federal Reserve, and more. These factors collectively contribute to the fluctuations we observe. Odeta Kushi, Deputy Chief Economist at First American, sheds light on this complexity:

“Ongoing inflation deceleration, a slowing economy, and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

Navigating Through Complexity with Professionals

While delving into the intricacies of these factors is possible, it requires considerable effort. Amidst the hustle and bustle of planning a relocation, diving into extensive reading and research may seem daunting. Instead of grappling with this alone, seek guidance from experts.

Professionals are adept at interpreting market conditions, offering succinct summaries of prevailing trends and forecasts, tailored to your specific circumstances.

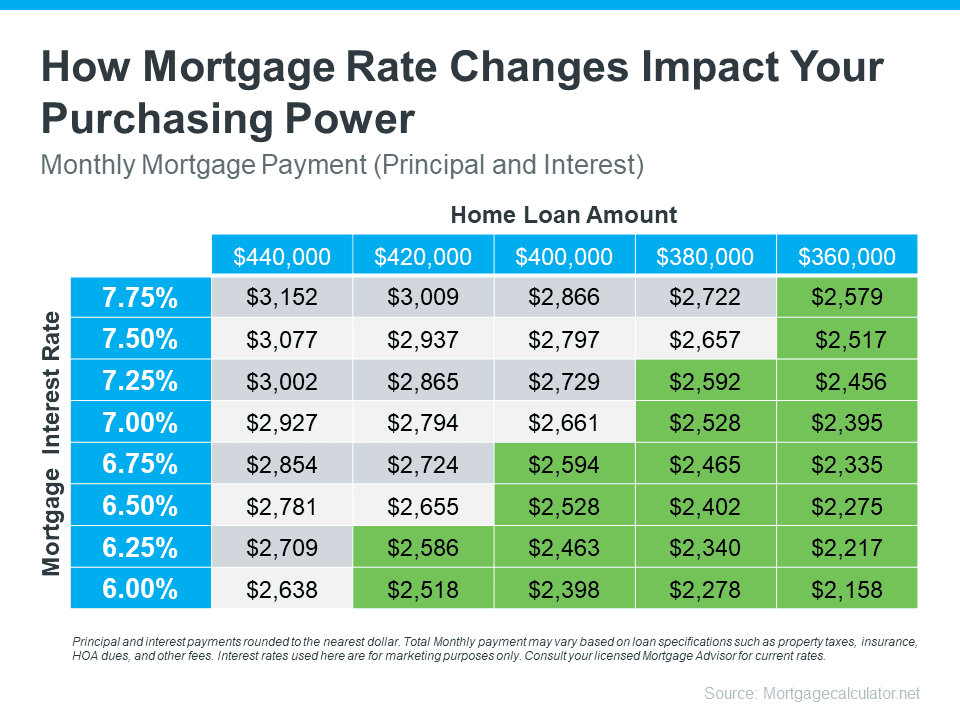

Consider this illustrative chart, which demonstrates how mortgage rates influence your monthly payments when purchasing a home. Picture being able to manage payments ranging between $2,500 and $2,600 within your budget (principal and interest only). The chart depicts payments falling within or below this range, based on varying mortgage rates.

Even a slight shift in rates can significantly impact the loan amount you can afford while adhering to your desired budget.

Tools and visuals like these contextualize market dynamics, elucidating their implications for you. Only seasoned professionals possess the requisite knowledge and expertise to navigate these intricacies effectively.

You don’t need to be well-versed in real estate or mortgage rates; you simply need an expert by your side.

In ConclusionCurious about the current state of the housing market? Let’s connect to decipher how prevailing trends directly affect you, empowering you to make informed decisions about your next move.